Understanding Fake Pay Stub Deductions: Your Deductions Explained

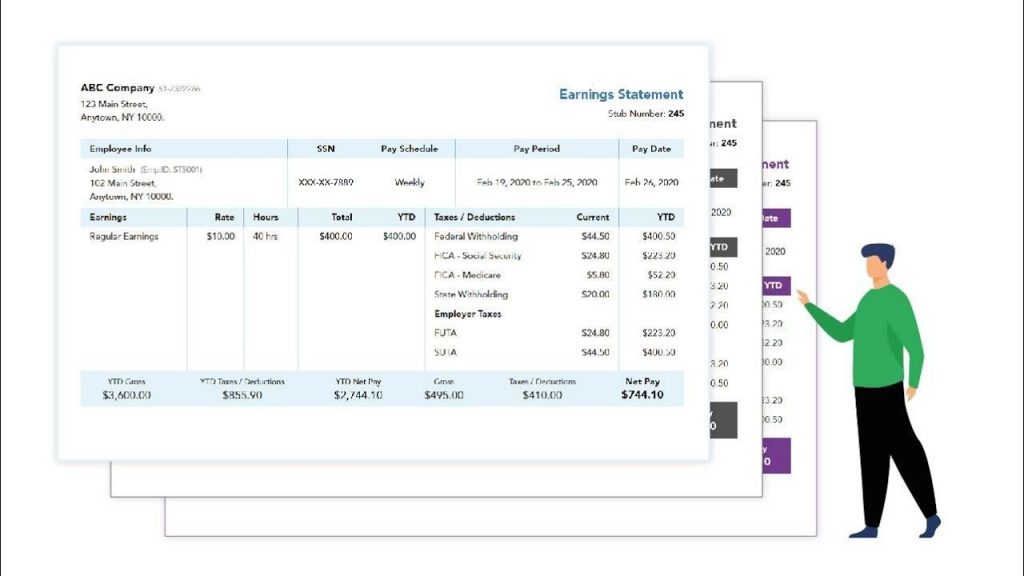

Common pay stub deductions are federal and state income taxes, as well as Social Security. These withholdings are responsible for a large portion of the difference in your net income and gross income. Depending on which programs you sign up with your employer, there may be additional deductions.

What is the Tax on a Paycheck?

The taxes taken from a paycheck are typically Social Security and Medicare taxes. This is also known as FICA (Federal Insurance Contributions Act). Below are the details of what taxes and deductions you will see on your paycheck.

Federal Income Taxes

Every paycheck is eligible for the federal government to receive a portion your income. This is called your withholding tax, which is a portion of your annual income taxes paid directly to the government. These payments have managed by the IRS.

The amount withheld from federal taxes will depend on how much you earn and what information you provided to your employer when filling out a W-4 or Employee’s Withholding Certificate.

Each allowance you take will result in less money being withheld from your federal taxes and more money added to your salary. Furthermore you will receive a larger portion of your income for federal taxes if you take fewer allowances.

State taxes

You may have required to pay an income tax depending on your location. Like federal taxes, money to pay state taxes has deducted from each paycheck.

Social Security

Every working American has required by the federal government to contribute a portion to Social Security. While this system of supplemental retirement programs have established in 1935. Therefore the Social Security fund provides benefits to current Social Security recipients.

Federal law requires that every worker contributes 6.2% directly to the Social Security fund. Every employer also adds 6.2%.

Medicare

The federal government requires every working American to contribute to Medicare, a U.S. government insurance plan that provides hospital, medical and surgical benefits for Americans aged 65 and older, and for people with certain disabilities. Therefore each worker contributes 1.45% to Medicare, and each employer pays an additional 1.45%.

Insurance

Your employer may have offered you life, dental, or medical insurance. These contributions will also have taken from your salary.

Retirement Savings Plans

Contributions to retirement savings plans such as a 401K plan will also be deducted from your pay. Because you can choose a percentage of your salary to have deposited to your retirement account when you sign up to a 401K program.

Flexible Spending Accounts

Flexible spending plans allow you to save pre-tax dollars for medical expenses such as prescription drugs, copayments, and also deductibles. Pre-tax income has deducted from the contribution to a flexible account.

Health Savings Accounts

Another way to save pre-tax dollars is through a health savings account. This account can have used for medical expenses. You will need to choose a high-deductible plan for your health insurance in order to be eligible for a savings account. Your pre-tax income has deducted from the contributions to a health savings plan.