In the realm of business, the accuracy and organization of financial records are paramount. Business bank statements play a pivotal role in showcasing a company’s financial health. This article will guide you through the process of creating impeccable business bank statements.

Understanding Business Bank Statements

What Are Business Bank Statements?

Business bank statements are official documents provided by financial institutions that summarize the inflows and outflows of funds in a business account during a specific period.

Why Are They Important?

Business bank statement provide a real-time snapshot of a company’s financial activities. They offer transparency, accountability, and valuable insights into the company’s cash flow.

Components of Business Bank Statements

Account Information

A business bank statement typically includes the account holder’s name, account number, and the statement period.

Transaction Details

Each transaction is detailed with a date, description, and transaction amount. This level of detail allows for precise tracking of funds.

Beginning and Ending Balances

The statement presents the initial balance at the beginning of the period and the closing balance at the end. These balances are essential for tracking changes in cash flow.

Steps to Create Accurate Business Bank Statements

Organizing Financial Data

Collect and organize all financial documents, such as receipts and invoices, before starting the statement creation process.

Categorizing Transactions

Assign categories to each transaction to create a clear breakdown of income and expenses. Proper categorization streamlines financial analysis.

Regular Account Reconciliation

Compare your bank statements with your internal financial records regularly to identify any discrepancies. Reconciliation ensures accuracy.

Utilizing Business Bank Statements

Financial Analysis

Thoroughly analyzing bank statements helps businesses identify spending trends, assess the effectiveness of marketing strategies, and allocate resources efficiently.

Tax Preparation

Business bank statement simplify the process of preparing taxes by providing a detailed record of income and expenses.

Supporting Loan Applications

Lenders often require bank statements when evaluating loan applications. Well-prepared statements enhance credibility and increase the chances of loan approval.

Ensuring Compliance and Transparency

Adhering to Regulations

Business bank statement must adhere to financial regulations and standards to maintain legal and financial transparency.

Preventing Fraud

Thoroughly reviewing bank statements can help identify unauthorized transactions and minimize the risk of financial fraud.

Advanced Techniques for Presenting Statements

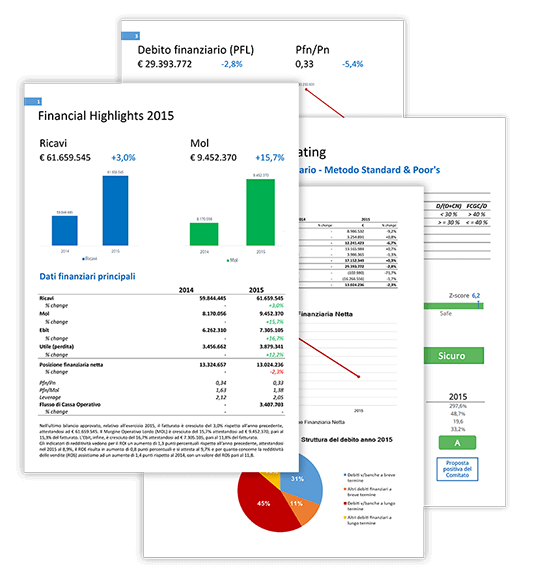

Visualizing Data

Incorporate graphs and charts to visually represent financial trends, making complex data more comprehensible.

Creating Comparative Statements

Comparative statements allow for a side-by-side analysis of financial data from different periods, aiding in tracking progress and identifying trends.

Read it: Pay Stub Bank Statement Generator: Simplifying Financial Record Access

Outsourcing vs. In-House Statement Preparation

Benefits of Outsourcing

Outsourcing statement preparation to professionals can save time, ensure accuracy, and provide expert insights.

Benefits of In-House Preparation

Preparing statements in-house allows for greater control over the process and a deeper understanding of the company’s financial data.

Common Mistakes to Avoid

Data Entry Errors

Inaccurate data entry can lead to misleading statements. Double-check all entries for accuracy.

Incorrect Categorization

Misclassified transactions can distort financial analysis. Use consistent and accurate categorization.

Read it: Unveiling the Truth About Fake Chase Bank Statement

Conclusion

Accurate business bank statements are a cornerstone of effective financial management. By following the steps outlined in this guide, businesses can create statements that provide a clear overview of their financial health and aid in making informed decisions.

FAQs (Frequently Asked Questions)

- Can I use software to create business bank statements?

- Yes, using accounting software can streamline the process of creating accurate and organized bank statements.

- How often should I reconcile my accounts?

- Monthly reconciliation is recommended to catch any discrepancies and ensure accuracy.

- Can business bank statements help with budgeting?

- Absolutely! Bank statements offer valuable insights into income and spending patterns, which can inform budgeting decisions.

- Are electronic bank statements valid for financial audits?

- Yes, electronic statements are legally valid and accepted as evidence in financial audits.

-

- What should I do if I discover an error in my bank statement after submission? Contact your bank promptly to rectify the error and update your records.